Taming Complexity: Addressing Infrastructure Monitoring Challenges in Banking and Finance

Banks and financial institutions operate in one of the most complex, highly regulated and risk-averse industries.

The IT infrastructure for these organizations is responsible for securing and supporting not just transactional systems but also highly sensitive customer data, mission-critical trading applications, regulatory compliance reporting and more.

As banking and financial infrastructure becomes increasingly complex, effective infrastructure monitoring and observability has never been more important.

The Challenges

The IT landscape in the banking and financial services sector is incredibly varied: from legacy mainframes and customer relationship management systems to multi-cloud services, hybrid architectures and multi-vendor solutions and managed services.

Infrastructure monitoring in these environments comes with its own set of challenges:

- Complexity and Scale: Banking infrastructure can encompass thousands of servers, databases, network devices and cloud services distributed across different geographic locations and time zones. These systems generate petabytes of data every minute and traditional monitoring tools often struggle to provide a complete, real-time view of the health of this environment.

- Real-time Response: In finance, even a few seconds of downtime or latency can lead to significant financial loss and damage to reputation, not to mention potential regulatory fines. In such a time-critical environment, being able to detect, diagnose and respond to issues almost instantaneously is of paramount importance.

- Compliance and Security: Finance is one of the most heavily regulated industries when it comes to IT operations. Solutions have to not only ensure that systems are operating correctly but also that they are doing so in compliance with strict regulatory requirements like GDPR, PCI-DSS and MiFID II. This extends to IT monitoring solutions which need to have compliance checks, data security and audit trails built in.

- Legacy Integration: Many banking organizations have core banking systems and legacy technology that they remain dependent on, which can add an additional layer of complexity when it comes to integrating such with modern observability tools and techniques.

Recommended Best Practices

Addressing these challenges require some of the following best practices for IT teams in the financial services and banking sector:

- Unified Observability: The first step towards resolving many of the challenges is to break out of the limited, one-dimensional view of the traditional monitoring approach. A complete observability platform is required which can pull in logs, metrics and traces from all layers, infrastructure components and services: physical, virtual or cloud based, no matter the type of vendor or location (on-premises or multi-cloud). An observability-first strategy offers unified visibility and faster issue detection and root cause analysis.

- AI-powered Root Cause Analysis and Remediation:

Monitoring solutions should leverage AI, ML and cutting-edge technologies to automate anomaly detection, automatically triage and correlate incidents and support fast remediation of incidents. Automating repetitive and low-level functions can significantly reduce the time required for root cause analysis and issue remediation, reduces the possibility of human error and dramatically increases productivity and adhering to service level agreements.

- Proactive Monitoring and Predictive Analytics: Don’t wait for incidents to occur and then start firefighting! Advanced monitoring solutions can provide predictive analytics, powered by AI that help detect potential failures or capacity issues before they become business-critical incidents and affect services and ultimately customers.

- Scalable and Flexible Monitoring Architecture: The right solution should scale dynamically with a growing infrastructure, new applications or evolving business requirements without increased risk of visibility gaps or performance issues. Monitoring tool architecture should also have the flexibility to meet specific, unique needs and potential constraints of banking IT environments.

- Robust Compliance and Security Features: Monitoring tools need to be able to continuously verify adherence to regulatory requirements and assess data security controls in real-time. They must have data encryption, user authentication, access controls, audit logs and provide native, simple to interpret compliance reporting.

Selecting Effective Infrastructure Monitoring Solutions

Banking and finance IT teams, when selecting or upgrading their infrastructure monitoring strategies need to look for the following capabilities:

- Real-time, Scalable Data Processing:

Solutions must be able to ingest, process and analyze vast amounts of data in real-time, with zero latency. This is to enable truly real-time alerts and incident response.

- Seamless Integration: Monitoring solutions must have the ability to seamlessly integrate with existing systems, including legacy systems, as well as the complete spectrum of modern solutions to ensure that no part of infrastructure is left unmonitored.

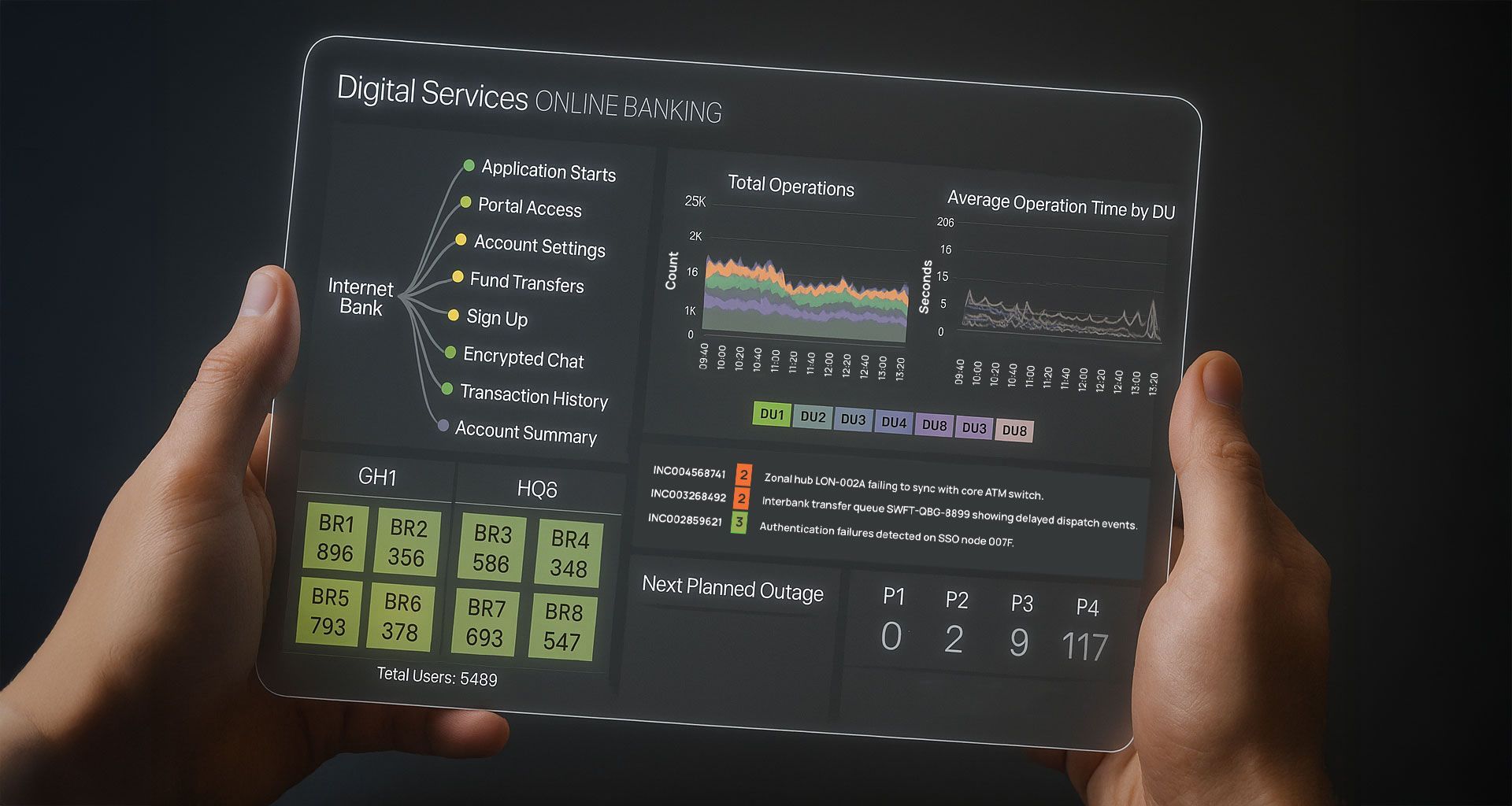

- Advanced Visualization: Complex banking and finance environments require monitoring to provide well-presented, customizable dashboards for rapid, effective decision making across teams to quickly triage and rectify issues.

- Vendor Neutrality: Vendor lock-in can be an issue for many technology investments. Monitoring and observability solutions should be vendor neutral and work with different technology stacks and platforms.

The Future of Infrastructure Monitoring in Banking and Finance

IT infrastructure monitoring in banking and financial services is critical to operations: organizations can no longer afford a situation where they cannot easily and frictionlessly determine the status of their most important, sensitive, business-critical systems and the services that are built upon them.

Modern, AIOps-powered service observability platforms like Interlink’s solutions, are equipped to provide full-stack, real-time visibility into infrastructure, systems and application performance, allowing organizations to move beyond a ‘reactive’ stance to monitoring with proactive and predictive capabilities to reduce business risks.

With unified infrastructure observability, automated and rapid root cause analysis and remediation, coupled with a strong focus on delivering real-time visibility and building in compliance and security best practices, leaves financial organizations better placed to ensure operational reliability, meet regulatory demands and maintain business continuity as the industry evolves.

Request a demo, see how Interlink Software’s observability solutions can help you to address your Infrastructure monitoring challenges.

What is Single Pane of Glass Monitoring and How Can Enterprises Leverage It for Enhanced Visibility?