Part Two: Turning Event Intelligence into Action - Real-World Value for Financial Enterprises

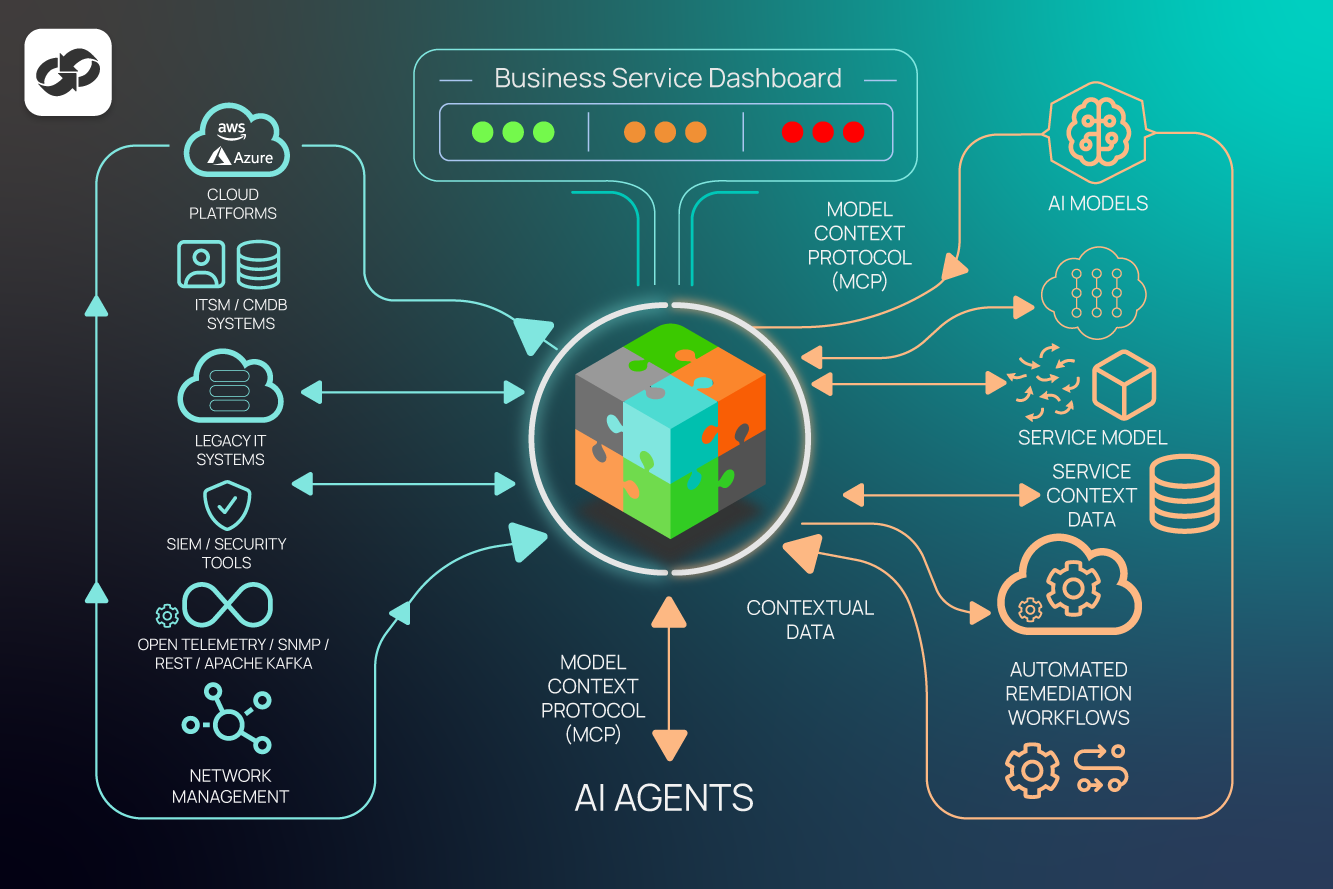

Event Intelligence Solutions are redefining how organizations manage complexity and risk across digital ecosystems. Their true power lies not only in detecting anomalies or suppressing noise, but in providing actionable, explainable intelligence that connects IT events to business impact.

Particularly in the Banking and Financial Services sector, where service uptime, payments processing and customer trust are paramount, Event Intelligence has become a strategic enabler of Operational Resilience.

By correlating technical data with business service context, platforms like

Interlink Software’s AI-powered Service Observability and Event Intelligence Platform help organizations resolve incidents in business priority order - aligning every IT action with what matters most to customers and regulators.

The practical applications are wide-ranging:

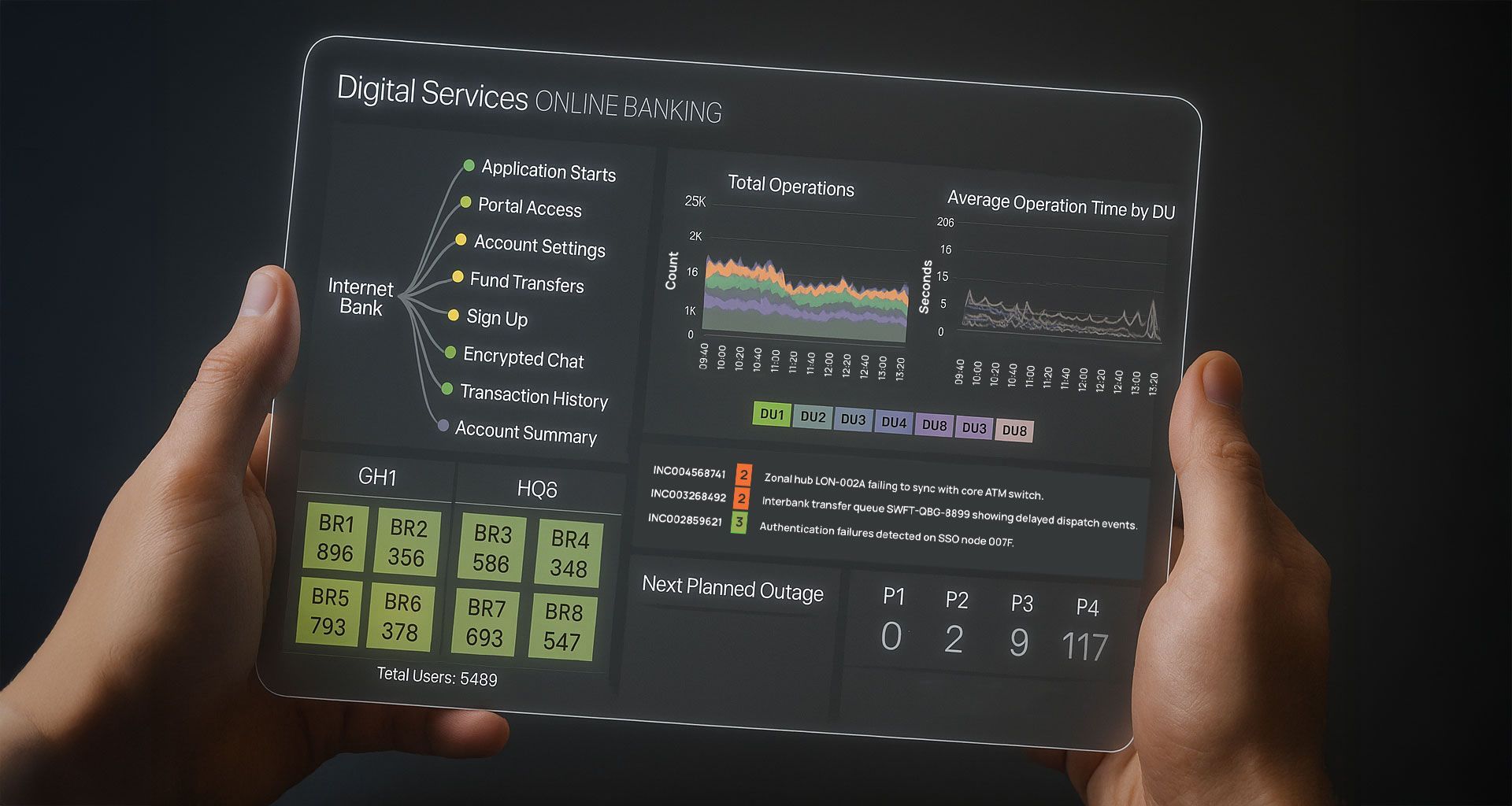

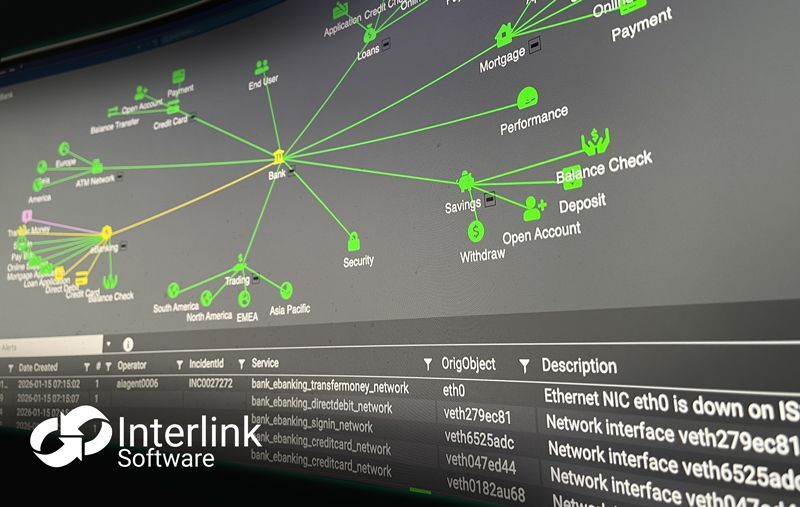

- Incident Prioritization and Root Cause Analysis: Interlink’s Event Intelligence filters out redundant alerts and groups related ones to expose true service-impacting incidents. This accelerates resolution and supports post-incident reviews with defensible, auditable evidence

- Proactive Service Health Monitoring: Through continuous machine learning and pattern recognition, Interlink detects degradations before they become service disruptions—reducing incidents typically around 50%

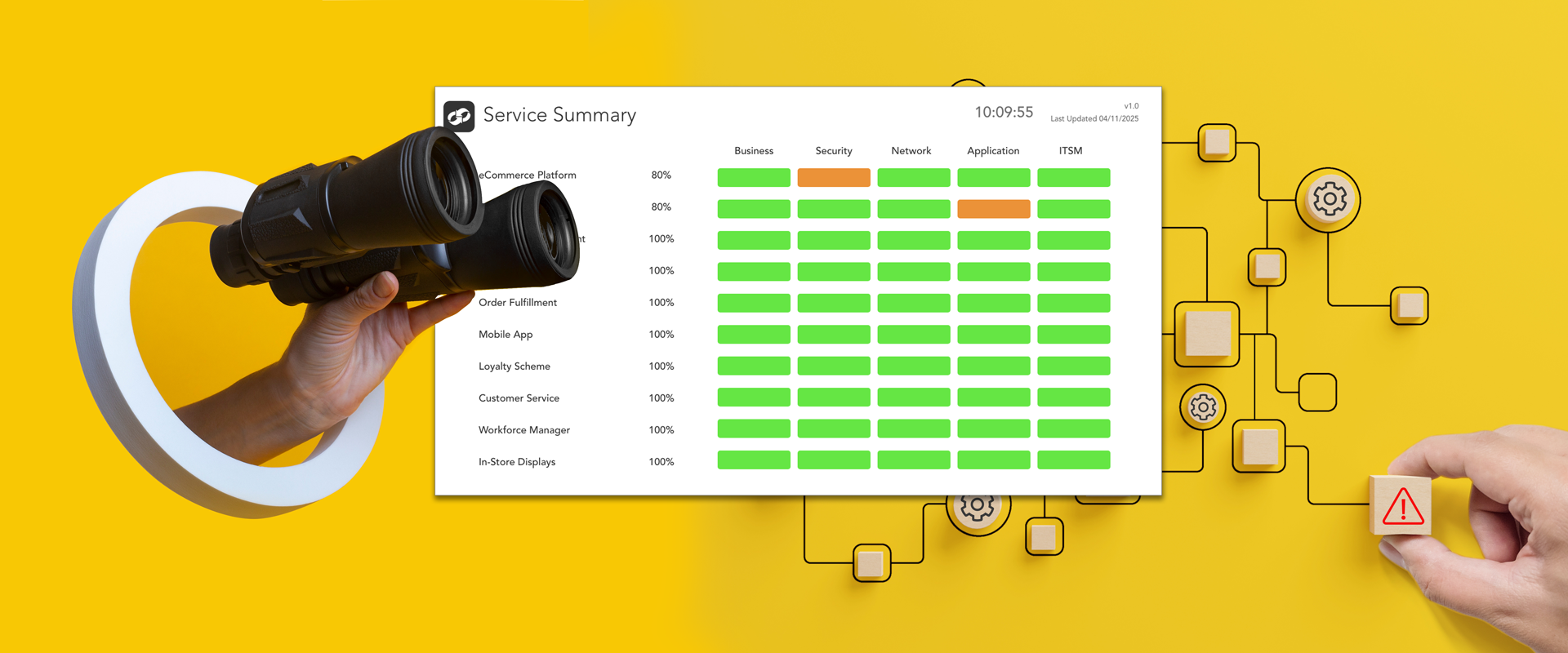

- Operational Dashboards for CIOs and Service Leaders: Real-time visualization of IT-to-business impact empowers stakeholders to make informed decisions based on true service health

- Automation and Collaboration: Interlink’s workflow orchestration connects seamlessly with ITSM tools, SIEM systems, Microsoft Teams and collaboration tools like Slack - bringing together ITOps, SecOps and DevOps teams for coordinated responses to threats to service availability

Where some vendors deliver opaque “black-box AI,” Interlink delivers Explainable AI that operators and auditors can trust. An integration-first architecture leverages existing monitoring and ITSM tools - avoiding vendor lock-in and maximizing return on existing technology investments.

This approach is particularly valuable for large,

regulated enterprises that must demonstrate service accountability under frameworks like the Digital Operational Resilience Act (DORA) and Prudential Regulation Authority (PRA) regulations.

Interlink’s already mature Event Intelligence capability, combined with its Business Service Observability focus, ensures financial institutions can infer the health of Business Services from every angle - infrastructure, application, security and end-user.

The outcome is a measurable improvement in availability, compliance and customer satisfaction.

For modern enterprises, Event Intelligence is more than technology - it’s a discipline for running IT Operations with business intent and with Interlink Software, it becomes explainable, auditable and proven in the world’s most demanding financial environments.

Turn Event Intelligence into Operational Resilience.

See how explainable, auditable AI supports DORA and PRA obligations while improving uptime and customer trust.

Speak to an Event Intelligence specialist

From Monitoring to Meaning: Why Service Observability Platforms Are Essential for Modern Enterprises